A step-by-step guide to change scheme preference in NPS account

When an investor subscribes to the National Pension System (NPS), an important decision to make is the fund distribution in NPS towards different schemes. The scheme selection and percentage distribution have to be initially done when opening a new account.

However, it is also possible to change scheme preference in NPS account at a later date, by logging into the eNPS website. This page will give detailed steps to set and change the Fund allocation in online NPS account. If the customer has an offline NPS account, then the changes have to be made through the Point of Presence (POP) or a POP Service Provider (POP-SP).

When setting the fund distribution in NPS account, the subscriber needs to primarily make the following decisions:

- Choose a Pension Fund Manager (PFM)

- Choose the percentage allocation of funds, towards different schemes (When using the NPS Active choice option)

- Choose the risk-taking capacity (When using the NPS Auto choice option)

How to choose scheme in NPS?

The Pension Fund Managers (PFMs) are the entities which are responsible to invest the contributed money, into instruments like Stocks, Bonds, Government securities etc. The PFMs manage the Pension Funds and the whole process works very similar to how Mutual Funds are purchased and redeemed. The NPS subscribers are the Beneficiary Owners (BOs) of the assets that are held by the Pension Funds.

Example: Suppose that an NPS subscriber chooses PFM XYZ as his/her fund manager. When the subscriber contributes money to his/her NPS account, this money will go to PFM XYZ. Depending on the distribution limits set by the subscriber, PFM XYZ will then invest the money and allocate units of the XYZ Pension Scheme to the subscriber.

The table below mentions the different available schemes under Tier 1 and Tier 2 accounts. It is possible to have a different PFM for Tier 1 and Tier 2 accounts. To understand the difference between these two accounts, refer: What are Tier 1 and Tier 2 NPS accounts?

| S. No | Scheme Type | Investment logic | Tier 1 | Tier 2 |

| 1 | A | Funds are invested in Alternate Investment Funds (AIFs), Real Estate Investment Trusts (ReITs), Infrastructure Investment Trusts (InvITs), Mortgage-Backed Securities (MBS) etc. | Yes | No |

| 2 | C | Funds are primarily invested in Corporate Bonds and other Fixed Income instruments with a good Credit Rating | Yes | Yes |

| 3 | E | Funds are primarily invested in the Stocks that are approved by PFRDA | Yes | Yes |

| 4 | G | Funds are primarily invested in Government securities | Yes | Yes |

| 5 | Tax Saver (TTS) | Funds are dynamically invested in Equity (Between 10 % to 25 %) and Debt instruments (Between 75 % to 90 %) | No | Yes |

Besides the above schemes, some PFMs also run additional schemes that are specifically available to the government employees. For example, Scheme CG, Scheme SG etc. (Refer: What are different NPS schemes for government employees?)

How to select scheme in NPS?

The returns generated by the Pension Funds will define the total amount accumulated at retirement time. So, the subscribers should make this decision carefully and consider at least the following factors:

- Age of the subscriber / Time to retirement

- Understanding the different schemes available under NPS

This is particularly important for the subscribers who choose to make Active Choice of the funds. Because in this case, the subscribers have to enter the percentage contribution towards different schemes like: E, C, G etc. - Understanding their own risk-taking capacity

If the subscribers do not have knowledge or interest in deciding the distribution in NPS schemes, then they can choose the ‘Auto Choice’ option. In this case, the subscriber will need to choose one of the following preferences: ‘Aggressive’, ‘Moderate’ or ‘Conservative’. These are also called as LC 75, LC 50 and LC 25, respectively. The fund allocation towards different schemes will be calculated automatically, depending on the risk preference and the age of the subscriber. - Reputation of the Fund Manager

- Expense Ratio of funds

- Assets Under Management (AUM) (Amount of money currently invested in these funds)

- Past performance of the Pension funds

etc.

The users can check the past returns generated by the NPS schemes by using this link from the NPS trust website. This is also published in business newspapers at regular intervals. It is recommended to consider the long-term performance of the funds, because the short-term results could be biased.

NPS scheme preference for a new account

When opening a new account, the subscriber has to decide the NPS scheme preference at registration time itself. In the ‘Investment options’ screen, the subscriber will need to select a Pension Fund Manager (PFM), and enter the percentage distribution towards the different schemes.

Similarly, the PFM and the scheme preference will also have to be selected for the NPS Vatsalya account for Minors. To get the detailed steps to open a new account, refer: How to open NPS account?

In the case the subscriber selects Auto Choice in NPS, then the percentage distribution in the schemes will be automatically calculated. For example, in the below image, we show the calculation result that is received, when Auto choice is selected with an ‘Aggressive’ option and when the age of subscriber is below 35.

Similarly, in the below image, we show the allocation percentage that is automatically calculated in Auto choice, when risk tolerance is ‘Moderate’ and the age is below 35.

Active choice

On the other hand, if the subscriber decides to select the ‘Active’ choice option for fund allocation, then the percentage distribution in different schemes will have to be manually added.

The maximum percentage that can be allocated in E scheme is 75% and for the A scheme, it is 5%. Whereas for the C and G schemes, the maximum allocation can be 100%.

After the allocation is set and the account is opened, it is still possible to change scheme preference in NPS at a later stage, by logging into the eNPS account using the Permanent Retirement Account Number (PRAN).

Procedure for scheme preference change in NPS

Changing the Pension Fund Manager (PFM) is allowed once a year and changing the scheme preference is allowed four times in a year. The subscribers can also switch between the Auto choice and Active choice of fund distribution. Just follow the below-mentioned steps.

Step 1: Login to the eNPS account using the PRAN and password. In case the password has not been set, or the password is forgotten, refer: How to change password of NPS account?

Go to the ‘Change Scheme Preference’ option under the ‘Transact Online’ menu. (or use the ‘Change PFM’ option to change the Pension Fund Manager)

Step 2: Enter the PRAN and ‘Tier Type’ for the account in which the NPS scheme changes are being made and click on the ‘Submit’ button.

As mentioned before, different NPS scheme preferences can be kept for a Tier 1 and Tier 2 account.

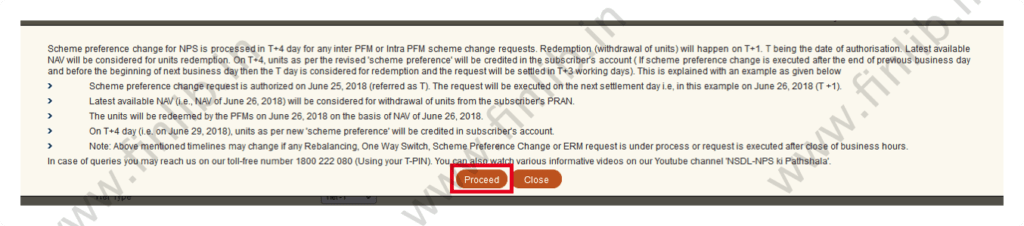

Step 3: A notification will be shown, giving details about the time it takes to make the NPS scheme preference changes in the account. Make sure to read this information and understand how long the process will take. Once ready, then click on ‘Proceed’ button.

Step 4: The information about the current Pension Fund Manager (PFM) and the current percentage distribution will be displayed. Information will also be shown about the number of changes that have already been made in this year. Click on the ‘Submit’ button to proceed further.

Step 5: A warning message will be shown that it is now possible to choose multiple PFMs for different schemes under the NPS. For example, the subscriber could choose E scheme of PFM 1, G scheme of PFM 2 and C scheme of PFM 3.

But this option is only available when the Active choice for fund selection is used. Also, these kind of changes can only be done 3 months after the PRAN activation date.

Step 6: Now, the subscriber will be able to set the new scheme preferences and PFM in his/her account. Depending on the requirements, select ‘Active choice’ or ‘Auto choice’ in the ‘Scheme Preference Type’ section.

Click on ‘Add’ button to add new rows for the PFM name and the scheme. If the Active choice in NPS is selected, then the subscriber would would need to add all the schemes that are needed and a percentage has to be allocated to each scheme in the ‘Percentage Contribution’. The sum of these contributions across the schemes should add up to 100 %.

Whereas in case of Auto Choice in NPS, the subscriber will need to choose one of the risk tolerance options: ‘Aggressive’, ‘Moderate’ or ‘Conservative’ and click on the ‘Add’ button. The subscriber will then be able to choose the PFM name. The percentage distribution will automatically get calculated based on the risk and the age of subscriber.

Once all the changes have been finalized, click on the ‘Submit’ button to change scheme preference in NPS.

Step 7: On this step, the subscriber can verify the NPS scheme changes that are being done in the account. If all the details are correct, then click on ‘Send OTP’.

In the image below, we are changing the PFM and the Scheme preference from Moderate to Aggressive. Hence, we see the ‘Y’ flag in front of these 2 parameters.

Step 8: An OTP will be sent to the registered email ID and the mobile number. Enter this OTP and click on the ‘Submit OTP’ button.

If everything is entered correctly, the request to change the scheme will be successfully submitted. The NPS scheme change currently follows a Settlement Cycle of T+4 days. So, the whole process will take at least 4 business days to complete, after the requested date.

If there are any problems when changing NPS scheme preference, then the users can raise a grievance with the NPS support team (Refer: How to log NPS grievance on CRA website?).

In this duration, the existing units will be sold and the money realized from the sale will be used to purchase the units as per the new distribution percentage (Refer image in Step 3). Also, any new contributions made in the account will be distributed as per the new NPS scheme preferences (Refer: How to make contribution to NPS account?).

Disclaimer

- This page is for education purpose only

- Some information could be outdated / inaccurate

- Investors should always consult with certified advisors and experts before taking final decision

- Some images and screenshots on this page might not be owned by FinLib