Beneficiary Owner (BO)

Who is a Beneficiary Owner (BO) and a Registered owner?

A Beneficiary owner (BO) (also called Beneficial Owner) refers to the final investor who has opened the Demat account with the NSDL or CDSL. When the securities are delivered to the Demat account, they are considered to be the property of the BO. The BO could be a single person or a group of persons.

Even though your Broker / Bank / Custodian etc. could be the Registered Owner of the securities, but they are not the final beneficiary. In some cases, the broker might have securities in their name or they might have power of attorney for the investor’s demat account; But again, the actual owner will be the investor in whose name the account has been created.

To open a Demat account, the investors have to contact a Depository participant (DP) and when the account is opened, investors will be allocated a unique client ID.

Demat account number (BO ID)

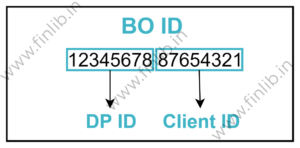

All investors who have a Demat account will be allocated a unique BO ID (Beneficiary owner ID). This is a 16 digit number that consists of 2 parts: DP ID + client ID.

Where DP ID refers to the Depository participant (DP) ID.

This is the unique ID allocated to your DP. This means that all investor accounts opened with one Stock Broker, will have the same first 8 digits. Each time a new broker is registered with a Depository, they are allocated a unique DP ID by CDSL / NSDL.

And, the Client ID refers to a unique ID which is allocated by the Depository to the investor with that particular DP. This should not be confused with the Unique Client Code (UCC), which is assigned internally by the DP to the investor.

Together, these form the 16 digit BO ID of the investor which in general terms is also called the Demat account number. A BO can hold more than 1 Demat accounts with multiple DPs using the same name and PAN number.

The investors can check their DP and Client ID in the Client Master Report (CMR).

How is it structured

To understand how the whole system works, investors can see in the diagram below that they do not have direct access to the Depositories. The DPs act as intermediaries between Investors and their Demat accounts, but the final beneficiary is the investor.

The BO can be an individual, group of individuals, HUF, company, Trust or any other legal entity which is allowed to hold the securities. If the BOs want to update any details in their account like address, nominee, contact details etc., then they have to contact their DPs.

If the Demat account is held with NSDL, the BO accounts are further categorized into House accounts and Non-House accounts.

So who is a Registered owner?

The term Registered Owner refers to the person / organization in whose name the securities are currently held and it could be a different person from the BO.

Example: If you have taken a loan from a bank against your shares, the shares might get transferred to the custody of the bank. So, in this case the bank is registered as the owner with the Transfer agents, until the loan is settled. But the investor is still the actual and final owner of the shares.

These days, since all securities are held in digital format, the investors can never theoretically become the Registered Owners. In the past, when the securities used to be held in physical format, the registered and the Beneficial Owner could be the same person as the shares used to be registered to and held by the individual investors.

But in Demat format, the registered owner will be the Depository Organization as they have the actual certificates of the securities. The investor will still be the final owner but they will just see the equivalent number of shares in their Demat account.

Disclaimer

- This page is for education purpose only

- Some information could be outdated / inaccurate

- Investors should always consult with certified advisors and experts before taking final decision

- Some images and screenshots on this page might not be owned by FinLib

- How Credit Ratings of Bonds will affect the yield?

- Bond Mutual Funds vs Bonds – Which is better?

- How market prices affect yield of bonds?

- How to compare yield of tax free bonds and Taxable bonds?

- How to calculate Bond Yield in different situations?

- How is Day Count Convention in Bond Market used?

- What is Coupon frequency in bonds?