How to do off market transfer of shares and other securities using CDSL’s easiest facility

The Investors who have a Demat account with CDSL, have the option of doing off market sale of shares electronically from their Demat Account. CDSL allows you to transfer all types of securities (Stocks, NCDs, ReITs, InvITs, ETFs etc.) from your demat account .

The online facility saves you the trouble of filling Delivery Instruction Slips for offline transfer. Although this facility is supported by CDSL, the Stock Brokers should have the technical capacity to support this facility as well.

You would need an Easiest account to perform the CDSL share transfer as the Easi account does not support transfer of securities. For the detailed steps to request a new Easiest account or upgrade Easi to Easiest, refer: How to register for CDSL easiest account.

This page will provide the steps to transfer shares from one Demat Account to another, where you receive money for the sale. For giving a gift to your relatives (or transfer to yourself), where you do not receive any money, please refer: Step by step guide to gift stocks to relatives using CDSL. No Stamp Duty has to be paid when gifting shares to relatives.

Some scenarios where you might need to do an off market sale

Here are some scenarios in which the off market sale will be useful:

- Securities which are not traded on the Stock Exchange (including the stocks of Startups)

- Securities are sold privately to some known contact / friend

- Selling to your family after you have exceeded the limit of gift amount in the year

- Open offers, Delisting, Buybacks etc.

Note: You will have to pay DP charges for this transaction and the amount will be debited directly from the cash balance in your trading account.

Steps for online transfer of shares using CDSL

Once you login using to your Easiest account, please follow these steps:

Step 0: Since this is a sale and you receive money for the transfer, you would need to pay a Stamp Duty for this transaction. This has to be paid before you can start the transfer of your securities and the amount of Stamp Duty will depend on the sale amount.

To see the detailed procedure for paying the Stamp Duty online, please refer: How to pay Stamp Duty for off market sale of shares.

Step 1: Add the Demat Account of the beneficiary to your ‘Trusted Accounts’ list. This is the account of the person to whom you wish to do the CDSL share transfer. This is a one-time process and for future transfers to this account, you can directly start the transfer process by selecting the BOs from your trusted list.

(Refer: How to update the trusted BO accounts in CDSL’s easiest)

Step 2: After you have added the trusted users to your account, click on ‘Setup’ option in the ‘Transaction’ menu.

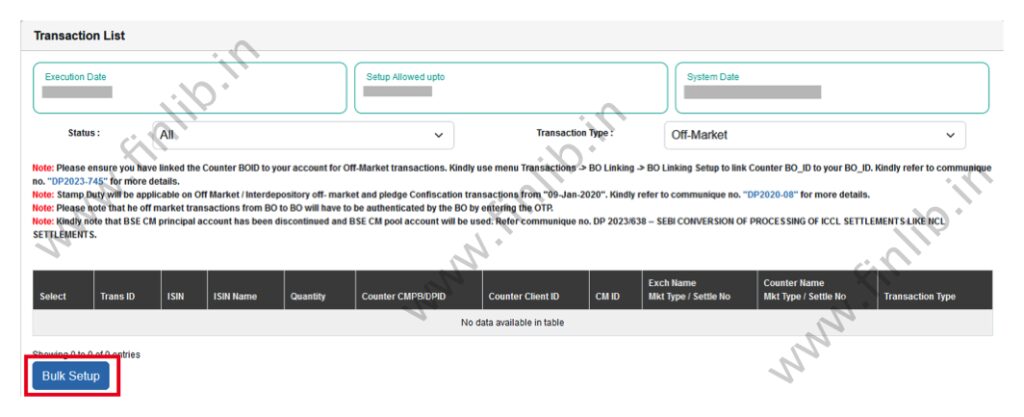

Step 3: In the Setup page, click on the ‘Bulk setup’ button.

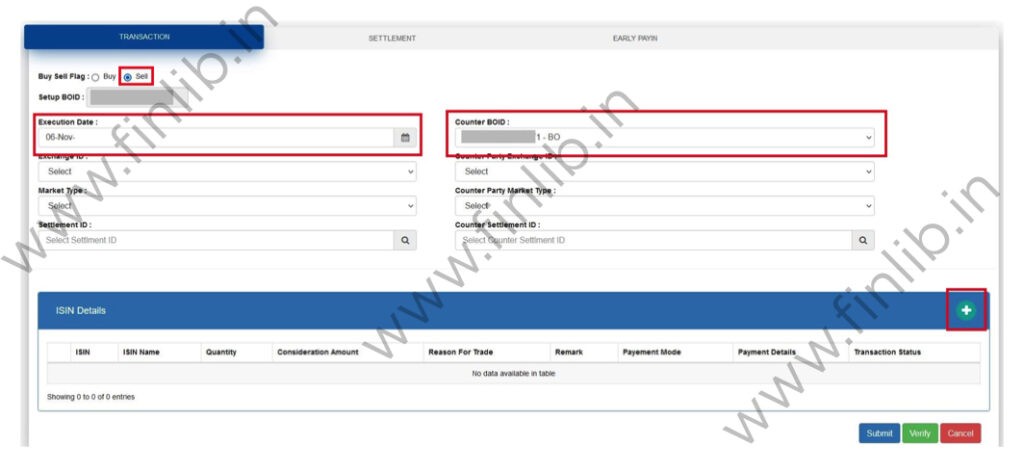

Step 4: Select the transaction type as ‘Sell’.

Enter the date on which you wish to execute the transfer of stocks and select the BO ID to which you want to transfer (The list of trusted BOs added in Step 0 will show here).

Next, click on the ‘+‘ button to add the stocks that you would like to transfer.

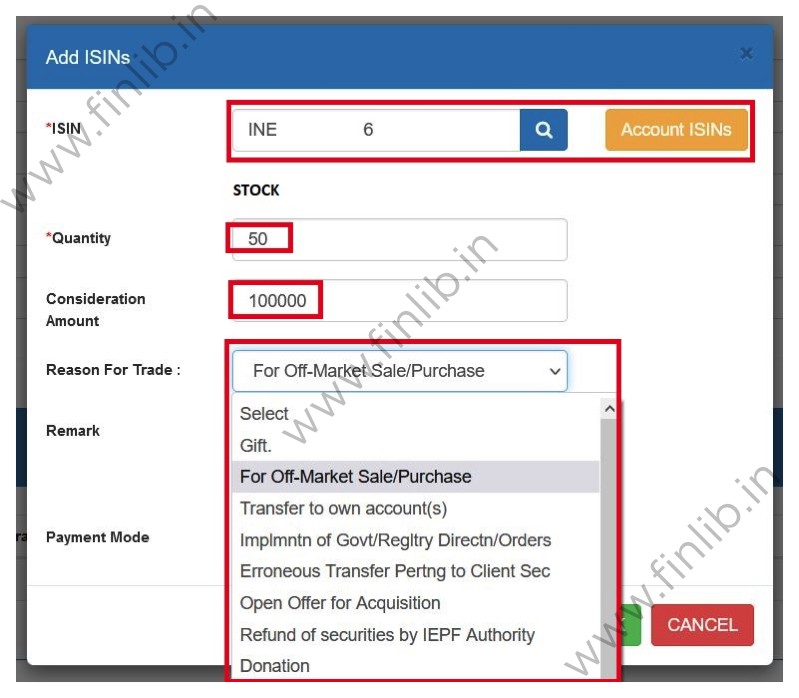

Step 5: In this form, select the ‘Account ISINs’ to view and select the stocks or other securities that you wish to transfer. Along with the ISIN details, add the quantity that you wish to transfer.

In the ‘Reason For Trade’ drop down box, select the option which is applicable to your transaction.

Enter the comments (optional) and the transaction amount. (This is the amount you are receiving for the off market sale of your securities)

Step 6: Enter the payment details about how the payment has been / will be received.

Step 7: After clicking OK, you will see that the transaction will be added under the ‘ISIN details’ section.

Click on the ‘Verify’ button.

Step 8: Once you click on ‘Verify’ in the above form, you will get a confirmation and the Transaction ID number.

Step 9: You can repeat the above steps 3 to 8 by clicking on ‘Bulk Setup’ again, if you wish to setup more than one transfer order.

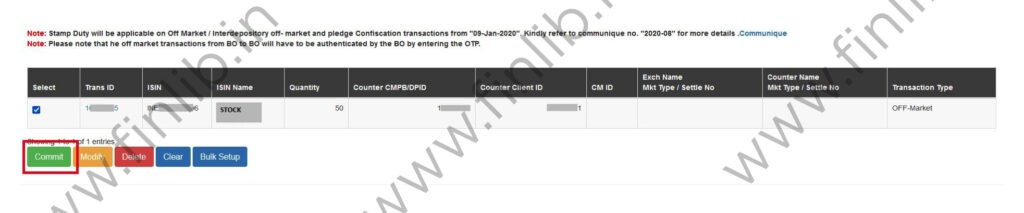

Once all the transactions have been added, double check the details.

Then select all the transactions (using the tick box) to verify and click on the ‘Commit’ button.

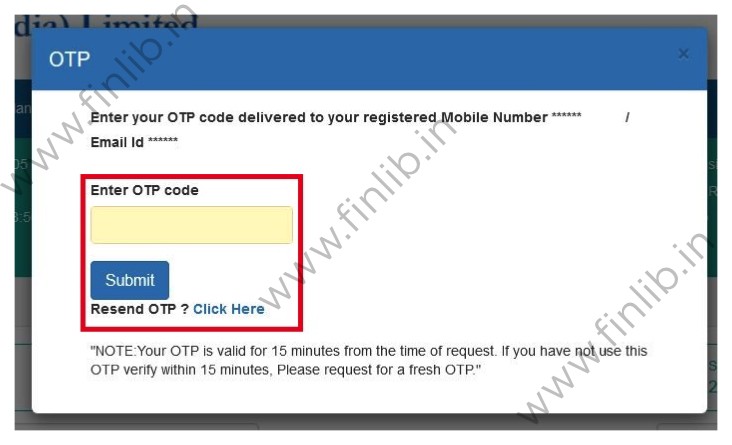

Step 10: For security reasons, you would need to enter the OTP sent to your email ID and phone number.

(If your registered email and phone number are not correct, then you would need to contact your Stock Broker or DP to update the details, before you can do the share transfer)

Step 11: After the OTP has been verified, enter your CDSL PIN to authenticate the transaction.

Step 12: Finally, you will receive the confirmation ‘Authenticated successfully’.

Once the transaction is authenticated, it will be submitted to your Depository Participant (DP) for verification. After the DP confirms the off market sale, the shares will be debited from your account and credited to the beneficiary account on the same day.

Note: Each DP has their own cutoff time so if you submit the transaction after this cutoff time, it will be processed on the next working day. Also, some DPs do not support transfers on holidays.

The Stamp Duty will also be deducted from your account at this stage, along with the debit of shares.

Disclaimer

- This page is for education purpose only

- Some information could be outdated / inaccurate

- Investors should always consult with certified advisors and experts before taking final decision

- Some images and screenshots on this page might not be owned by FinLib